To bring a world of financial opportunities to an ambitious Kingdom

We enjoy a unique position as the leading international bank in the Kingdom of Saudi Arabia. We give our customers the highest quality service and an unmatchable breadth and depth of experience and know-how from local and international best practice, delivered through digital and personalised service driven by customer preference. Our strategic partnership with HSBC Group, one of the world’s leading financial institutions, positions us as a preferred banking partner. As a leader in key segments of the financial sector, we will be where the growth is in Saudi Arabia.

Five Reasons to invest in SAB

1. Leading international bank in the Kingdom

Our institution has developed into the leading international bank in the Kingdom through a deep understanding of the needs of our customers and a bespoke product suite that delivers intrinsic value. Our unique partnership with HSBC Group enables us to bring international connectivity to our customer base and aligns our approach with global best practice. We are the ‘go-to’ Bank for inbound and outbound multinational corporates and institutions operating into or from Saudi Arabia, and the number one bank in the Kingdom for trade.

2. Increased scale to support Vision 2030 growth aspirations

The Kingdom is navigating its path through undoubtedly its biggest economic transformation programme, bringing a wealth of opportunity to every family and enterprise domestically, but also playing to international opportunities. Through our robust balance sheet and market-leading suite of products, we possess the scale and capability to support such an ambitious programme.

3. Financial strength

Historically, we have delivered top tier financial performance from a strong balance sheet, robust funding and liquidity dynamics, and a solid capital position. Following the merger with Alawwal Bank, we have taken the necessary steps to protect our balance sheet and conservatively manage the provisioning of our portfolio. We are still in a position of strength to meet the demands of our customers.

4. Positioned for growth

We have successfully completed the integration of our two banks, following the merger of the then named Saudi British Bank with Alawwal Bank, and we have moved swiftly into investment and growth mode. Our Strategy 2025 is growth-focused and supported by a drive to digitise the banking platform and customer experience. Our growth agenda aims to build on our strengths in our corporate franchise and provide a more enhanced retail provision to support the growing needs of our retail customers. Our long-term strategy coupled with a core set of finance fundamentals and a robust economy positions us well for growth.

5. We are safe, sustainable and dependable

A robust approach to corporate governance is a key strength for any organisation and we ensure we adopt best practices in this field to create value for all of our Stakeholders. The Board sets the Bank’s strategy and risk appetite with the aim of achieving sustainable value and promoting a culture of openness and debate. Our Board brings a successful balance of international banking best practices, together with local, commercial and institutional insight and experience.

We conduct our business using a responsible and sustainable approach in line with our values, and our business decisions are made in the interests of all concerned Stakeholders, including our customers, employees, Shareholders and our wider community.

2024 Key numbers

16.0%

Underlying return on tangible equity

SAR 14.0 bln

2024 Revenue

SAR 3.78

EPS

1.6mln

Retail Customers

c.28k

Corporate and institutional customers

SAR 35.3bln

Mortgage portfolio

12.50%

Corporate lending market share

24%

Trade market share

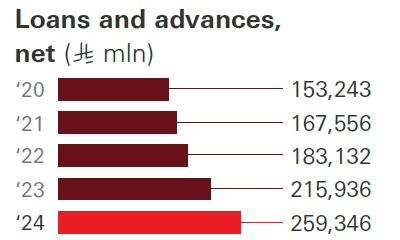

SAR 265.6bln

of gross customer loans

15.4%

CET 1 ratio

49%

Shareholding in HSBC SA - the leading investment bank in the kingdom

Rating Agency

- Moody's

- Fitch

Credit Rating

Credit Rating

Investor contacts

Saudi Awwal Bank is pleased to receive Investor enquiries at:

For retail shareholder enquiries:

You may contact the Shareholders Affairs unit in the following ways:

Mail: P. O. Box 9084 Riyadh 11413

E-mail: reg.hor@sab.com